When you give a gift of stock you are saving people's lives.

Want to learn how?

Contact our team for more information by calling 613-257-GIVE (4483) or by completing this form. Your generous contribution will play a crucial role in ensuring quality healthcare for you and your loved ones as well as make a positive impact in your community.

The end of the year is fast approaching – now is the best time to make a difference in the lives of others by transferring a gift of stock or security – all while saving you money on capital gains.

Doing so before the New Year could mean greater tax savings. Make the most with your gift TODAY to support healthcare at the Carleton Place & District Memorial Hospital. Your generosity today can make a lasting impact! Call your financial or tax advisor TODAY to get the best results before the New Year!

Capital gains help build better better healthcare. Tax-free.

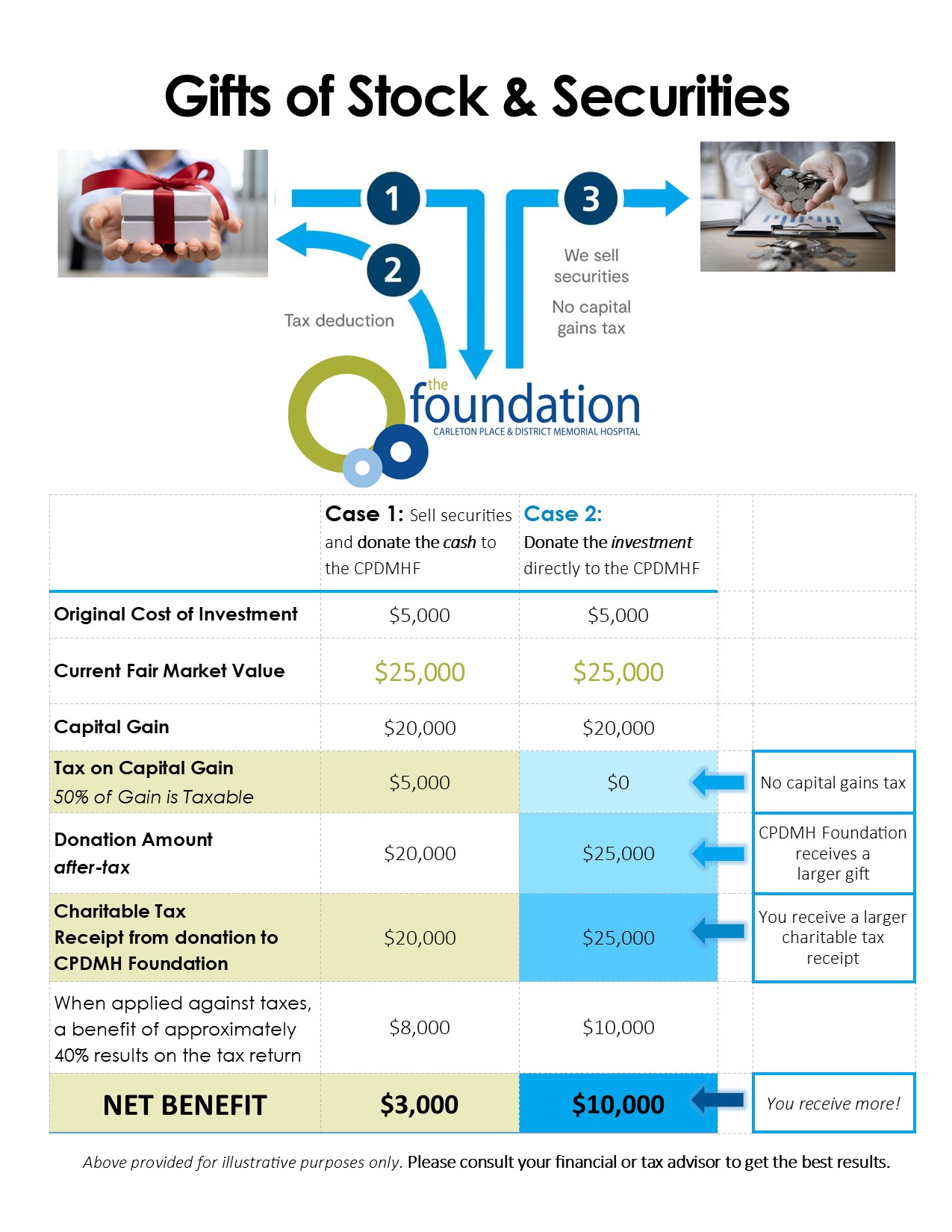

Innovative provisions to taxation have been made that encourage greater philanthropic activity in Canada. Specifically, donors who donate certain publicly traded securities "in kind" to Canadian private foundations or registered public charities, including the Carleton Place and District Memorial Hospital (CPDMH) Foundation, are now exempt from the payment of capital gains tax on any profit created by the fair market value of the donation.

Qualifying securities include stocks, bonds, trust units, exchange-traded funds, segregated funds and mutual funds units to name a few, as well as shares acquired on exercise of employee stock options, although the process for tax reporting is different on the latter.

In order to qualify, the following criteria must be met:

The donation must be made "in kind" (or in their current form, unsold). The shares must be publicly traded on Canadian or other major international exchanges (private company holdings do not qualify at this time).

Under the old rules, tax was payable on 25% of the capital gains realized on the fair market value of the donated securities shares. Due to changes in the 2006 Federal Budget, there is now no tax payable on any of the capital gains realized. However, all of this changes in January 2024 with new rules being proposed to the “alternative minimum tax” (AMT). Instead of 0% capital gains tax when gifting securities to a charity, 50% capital gains tax will be applied.

The proposed rules are much more complex than simply those to capital gains, but making a larger gift before December 31, 2023 can avoid these future consequences. Therefore, if you have securities that have grown in size since you purchased them and you would like to use these as a gift to your favourite charitable organization, making a gift in 2023 instead of 2024 (or beyond), could result in a significant tax savings for you. Talk to your local financial advisor today for more details about how you will be impacted by AMT and what you can do before the end of the year.

Transfer and Authorization Form

Please click here to complete our Transfer and Authorization Form to make your gift of stock and securities today! To ensure a tax receipt for the current fiscal year, we highly recommend starting the transfer process as soon as possible.

Please contact your financial or tax advisor to get the best results.

For more information about donations of Gifts of Stock and Securities to support the Carleton Place & District Memorial Hospital, please contact: Robyn Arseneau, Executive Director, 613-257-GIVE (4483) roarsenau@mrha.ca or complete this form.